What hot air balloons teach us about fintech growth

Lessons from Google Loon, and how to expand beyond the 'usual' set of products in fintech.

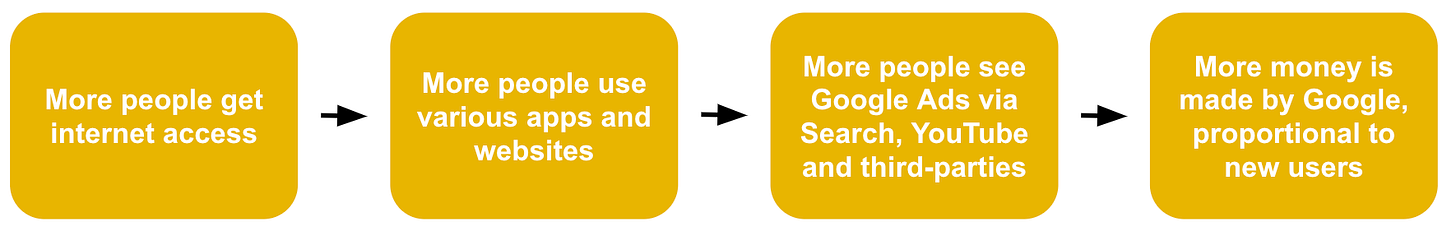

Out of Google’s ~$161b in annual revenue last year, it made most of its money from ads, thanks to Search, AdWords and YouTube; owning ~31% of global digital ad spend.

This doesn’t come by surprise: people visit Google +14b times a month and make 1.2t searches every year—and this is only with half of the world having internet access.

With all this money, Google funds some pretty cool side projects through its lab, X.

Loon—one of these projects, announced in 2013—has a mission to fly a network of hot air balloons to provide internet access to the 3.3b people who live without it. Though it’s recently shut down, there are quite a few lessons

The concept and approach sound outlandish (the word ‘Loon’ is even synonymous with a foolish person), especially for some search engine company. But there’s more to it than what meets the eye:

Through a third-order effect, Loon was imperative for drastically growing Google’s core businesses in the next 50 years and beyond.

Loon would expand Google’s total available market (TAM) by reaching people who currently can’t be users and providing them with the infrastructure they need to become users.

To generalize this:

Let’s call the group of people that aren’t currently included in a company’s TAM, but could be if ‘enabled’, marginal clients.

Let’s call the process of implementing a product/service that provides support to ‘enable’ marginal clients to be included in a company’s TAM, the Loon Effect.

Consumer fintech companies will need to create a Loon Effect and create novel financial product experiences to differentiate and continue growing.

These novel financial products will likely do this by creating new segments in existing financial services product verticals.

Product Verticals in Financial Services

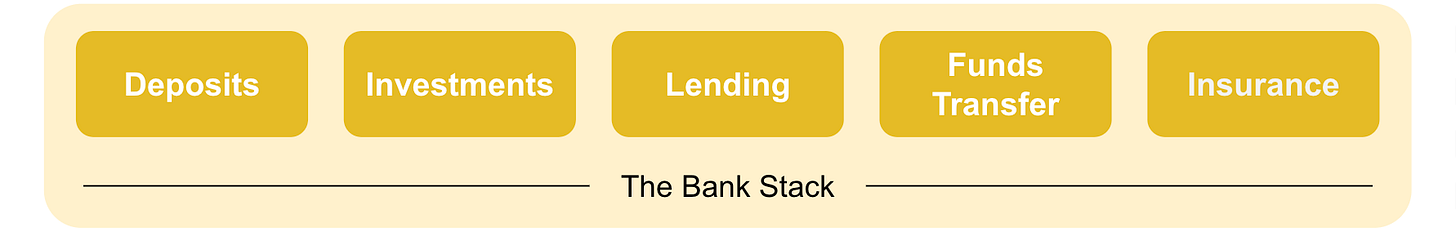

In Canada, all Schedule 1 FIs are entities consolidated of the five core product verticals that consumers need when it comes to financial services. You can conduct all your life’s finances from one institution (for the most part).

These ‘verticals’ within the bank are often siloed departments that internally operate their business functions independently from one another.

The problem arises when siloed business functions have to work alongside shared corporate functions:

The shortcomings of FIs in providing great product experiences come from corporate functions shared across verticals being spread too thin (data science, customer service, experimental product development and P&L responsibilities).

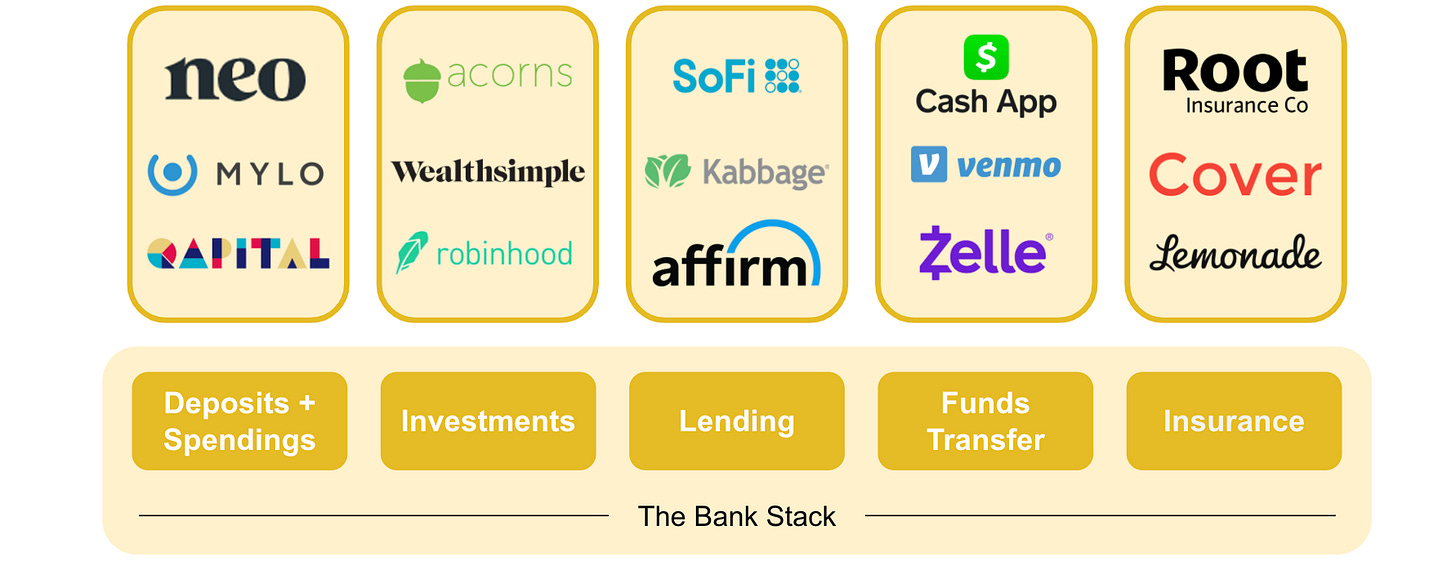

The opportunity for consumer fintech companies is in improving these mediocre experiences across a bank.

They take on solving a problem very effectively in one vertical, and when they can, expand to the other verticals.

Robinhood and Wealthfront moving into cash management

Marcus (formerly Clarity Money) moving to lending—after being acquired by GS

The goal for consumer fintechs is to take on incumbent FIs — and that means they have to expand into all five verticals and do them very well.

The first fintech to 5, has a huge advantage over the rest.

The verticals are saturated already, but the products offered are nothing new in the core product structure than the banks.

The fintechs that play in each of a bank’s verticals simply recreate the products offered by banks, and that’s not enough.

Once you’ve replicated a consumer banking product, there’s only so much incremental improvement that can be expected to attract new customers; there have to be wholly new product offerings.

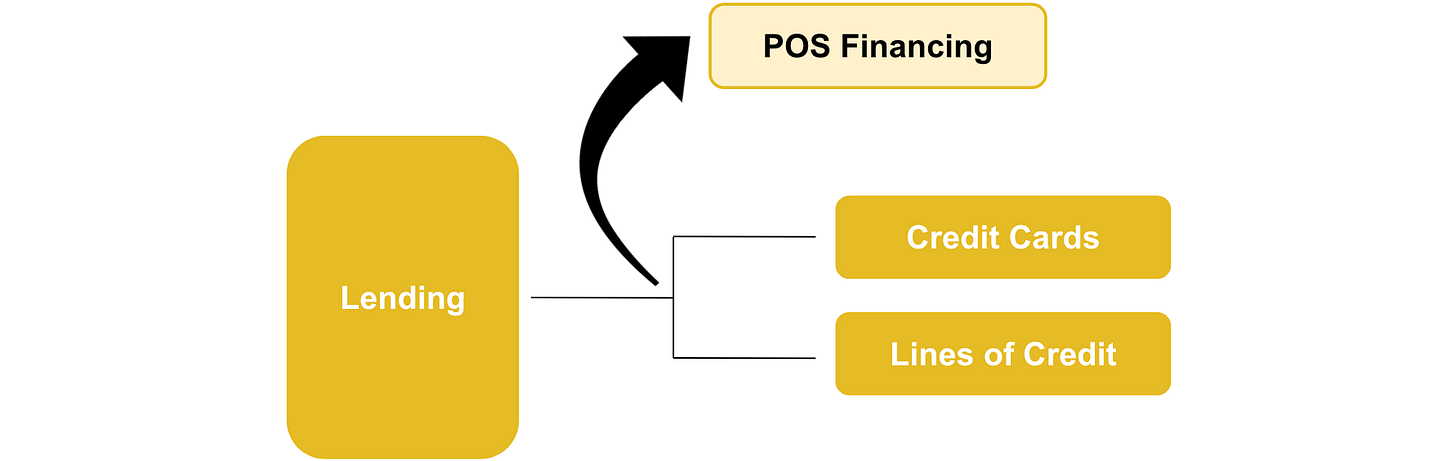

Affirm, for example, combined the flexiblity of a line of credit and accessbility of a credit card to give consumers who made big purchases but couldn’t immediately pay them off a novel product experience—an idea still in its infancy for many FIs.

Now, Affirm didn’t apply the Loon Effect in their POS Financing product because there’s no non-primary-order business that gets a boost from a product like Affirm’s.

But, if a bank were to take from this idea and integrate flexibility into a credit card product or accessibility into a line-of-credit product, then we’re onto something:

CIBC, one of Canada’s big 5 FIs, quietly rolled out an installment plan option into their credit cards (essentialling a POS Financing offering), letting consumers buy like normal, but have a more flexible (and cheaper) payback experience.

CIBC applied the Loon Effect. The TAM of their conventional lending business increases by the number of consumers who needed the flexibility and accessibility of a POS Financing offering to ease their financial situation, which before restricted them from safely taking on those conventional lending products.

CIBC enabled marginal clients to be able to use their conventional lending products by pushing out a wholly new financial experience.

Often FIs don’t significantly innovate on their core products because they're scared of that new product’s threat to their bottom line in the status quo.

But over a multi-decade period—at the risk of sounding cliche—disrupting oneself is the best way to protect being disrupted by another.

And we do that, by applying the Loon Effect, in this case by creating new segments in existing financial services product verticals.

Closing Thoughts

Until recently, companies had to inherently provide financial services to consumers and enterprises (therefore dubbed fintech); making for a ‘1st order’ avenue for helping customers with their money.

Lately, we’re seeing a deeper integration of fintech services among larger non-fintech companies.

Shopify provides money management for merchants. Ride-sharing companies doing the same for their drivers. Even Starbucks essentially works off pseudo-payments rails for much of their orders.

For these companies, ‘embedding fintech’ in their products is the implementation of the Loon Effect.

Except we see the expansion of touchpoints with a customer, rather than expanding the same set of touchpoints to more customers.

This is very new, and it’s bound to provide a higher-fidelity experience between brands and their customers and users.

Astro Teller, Head of Moonshots at X (Google’s experimental lab) talks about attacking the ‘talking monkey’ first: go after the hardest part of the idea and prove it can work (by trying to find why it can’t), and then move to the easy parts.

The one modification to this? Create more hard problems to go after outside of the current concept.

Things are getting exciting, and I hope you’re now closer to the front seat of speculating the shift in fintech after 🤓

If you enjoyed this read, I’d love to hear from you! Don’t hesitate to shoot a ‘hello’ over email or we can connect on Twitter 🙌🏼

Cheers 🥂